When Will the Sellers’ Market End?

When the pandemic hit in early 2020, the Fed dramatically reduced interest rates. These low rates, combined with historic low inventory levels, resulted in a three-year sellers’ market. When, in the summer of 2023 rates more than doubled, market volume dropped by almost 30%. Prices, however, dipped slightly but then recovered. Where are they headed in 2025? Read on to learn more.

If you’re considering buying or selling a home, chances are you’ve been noticing the headlines. If that’s the case, you may be confused by all the conflicting predictions. To shed some light on the topic, here’s is quick review of the basics. Home prices are always determined by the balance between the supply of homes for sale and the number of qualified buyers in the marketplace. In other words, supply and demand.

What is a Sellers’ Market?

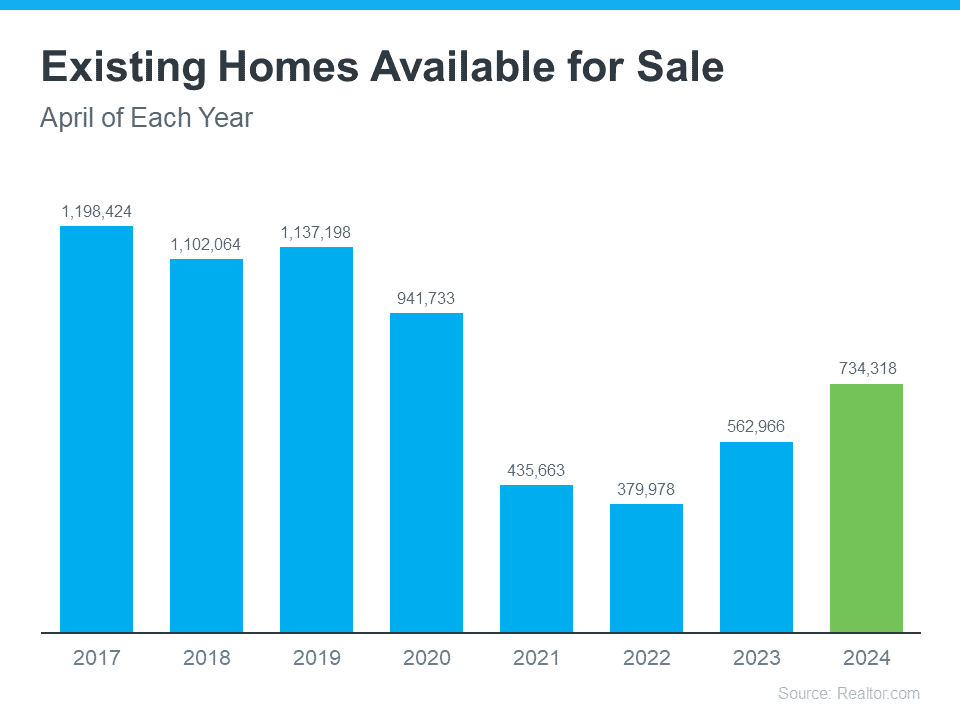

The price of a home is set when a seller accepts a buyer’s offer. Historically, a balanced market exists when there are six months of inventory. In a balanced market, neither buyer nor seller has an advantage. In a sellers’ market, the inventory level is below six months, meaning fewer homes are are available for sale than qualified buyers. The chart below shows the total number of homes for sale in April at the national level going back to 2017.

When the pandemic hit in 2020, the market experienced a period when the inventory of homes for sale dropped and ranged from 25% to 50% of normal. At the same time, buyer demand, fueled by historic low interest rates, was through the roof. The result was more buyers than homes and intense bidding wars, which resulted in double-digit home price appreciation.

Portland Metro Inventory History

The chart below shows the inventory level in the Greater Portland market area from 2019 through 2024—the number of homes for sale increases in the spring and peaks in the summer. Inventory levels drop during the winter months. Historically, the Portland Metro home inventory ranges between a low of 1,200 and a high of 2,400 homes for sale. In the first quarter of 2020, inventory levels dropped and have not returned to normal. During this time, inventory ranged between 25-50% of normal … buyer demand was strong, buyers had to compete for the limited inventory, and home prices escalated dramatically. The result was a strong seller’s market and double-digit home price appreciation.

The Millennial Generation is Now the Largest Segment of the Population

The other component driving the sellers’ market is additional buyer demand. The Millennial Generation (ages 18-36) is now the largest segment of the U.S. population. They have jobs and have been living in apartments or their parent’s basements and are anxious to form families and buy homes. In short, they are motivated, ready, willing, and able buyers looking for homes. This combination of low inventory and the upsurge in demand due to the coming of age of the Millennials has been a critical driving force for the recent sellers’ market and rapid home price appreciation.

When Will The Sellers’ Market End?

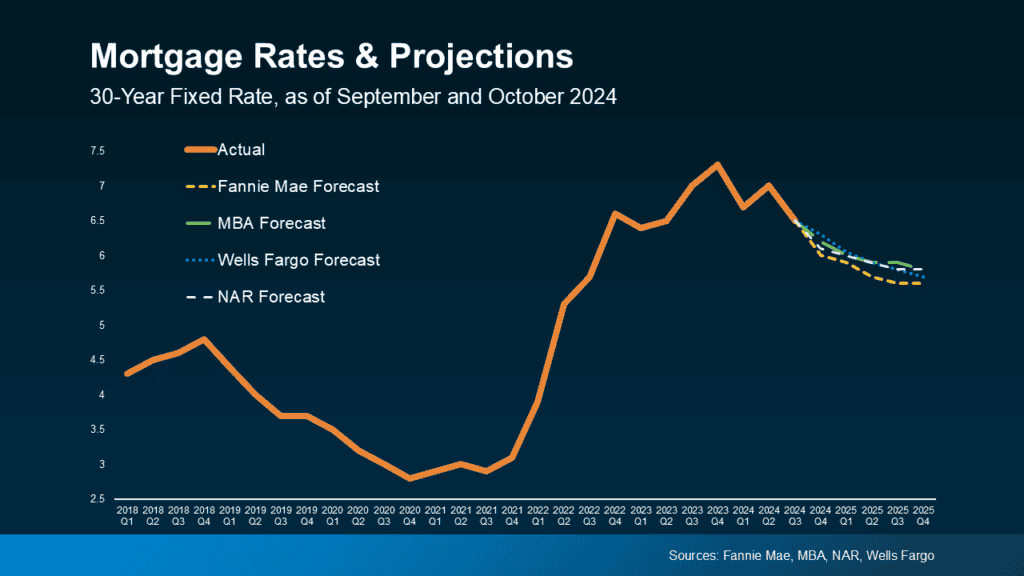

While no one can predict the future, the dramatic rise in interest rates in the summer of 2022 squeezed many buyers out of the market. When interest rates rise, buyers lose buying power. This means buyers have to settle for a lower-priced home or offer a seller a lower price for their home to qualify for the monthly payment. The chart below shows the course of mortgage rates from 2018 through October 2024.

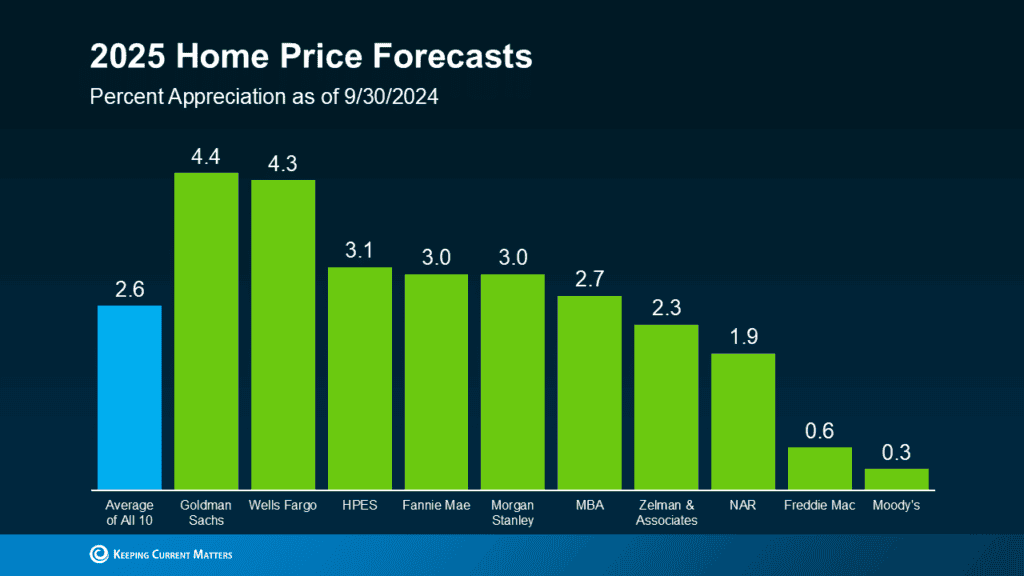

As interest rates do come down, more buyers will enter the market. The chart below shows the current home price appreciation forecast for 2025.

Bottom Line

If you’ve been holding off selling because of uncertainties about the market, it makes good sense to explore your options now. If you’ve owned your home for an extended period, your home’s value has increased dramatically, and you’ve realized a nice gain on your home investment. According to most experts, home price appreciation will trend back to more normal levels in 2025 (see graph above).

The graphic above shows the current Market Action Index here in Portland Metro. If you plan to move anytime in the next three years, it’s in your best interest to schedule a time to get together for a Pre-listing Consultation. The consultation is an informal, no-pressure conversation where we look closely at your home to determine its current market value range and provide you with suggestions about potential updates or repairs that you may or may not want to complete before selling.

To schedule a time to chat, click here: Home Analysis.

If you’re just curious about your home’s current value … click the following link to get an instant value range for your home: What’s My Home Equity?

Concerned About Selling Before You Buy?

When it comes time to sell, getting your home sold for top dollar is job one. The key to accomplishing that goal is to have a proven plan in place that will enable you to secure your next house before moving out of the current one.

The SkyBlue Sell-Buy Program can help you make this a smooth transition. Which strategy you use depends on your goals and individual situation. Check out our article How to Sell and Buy a House at the Same Time.