Five Steps to Getting a Mortgage

When it comes to buying a home in today’s crazy-hot real estate market, there’s so much to think about. So much preparation. So many important decisions to be made. Serenity now!

But you’re on the right track already.. Because I (Rachel Bradley) know the terrain. And I’m going to walk you through it, step by step.

By planning ahead, you’re in a better position to negotiate and move forward on the purchase of your next home. As your Accredited Buyers Representative (ABR®) and a Principal Real Estate Broker, I’m here to make sure you get all the help you need to successfully complete your purchase, including reviewing and selecting the best lender for your situation.

It’s important to enlist a knowledgeable local lender who has your best interest at heart. And to do your homework and ask questions. During our initial buyer consultation, I’ll provide you with a list of proven local lenders who delivered great results for the diverse needs of my clients. I’ll also answer general lending questions and advise you on your next steps.

5 Steps to Getting a Mortgage in Today’s Market

- EVALUATE AFFORDABILITY Lenders and mortgage insurers look at a variety of factors, but the two most important are your monthly mortgage payment and your total debt load, relative to your gross income. As a home buyer, it’s also important to consider additional expenses, beyond your mortgage payment, that can impact how much you can afford for a home. Depending on your situation, these other expenses could include property taxes, mortgage insurance, homeowners’ insurance, home maintenance expenses, homeowner association fees, parking expenses, and utilities.

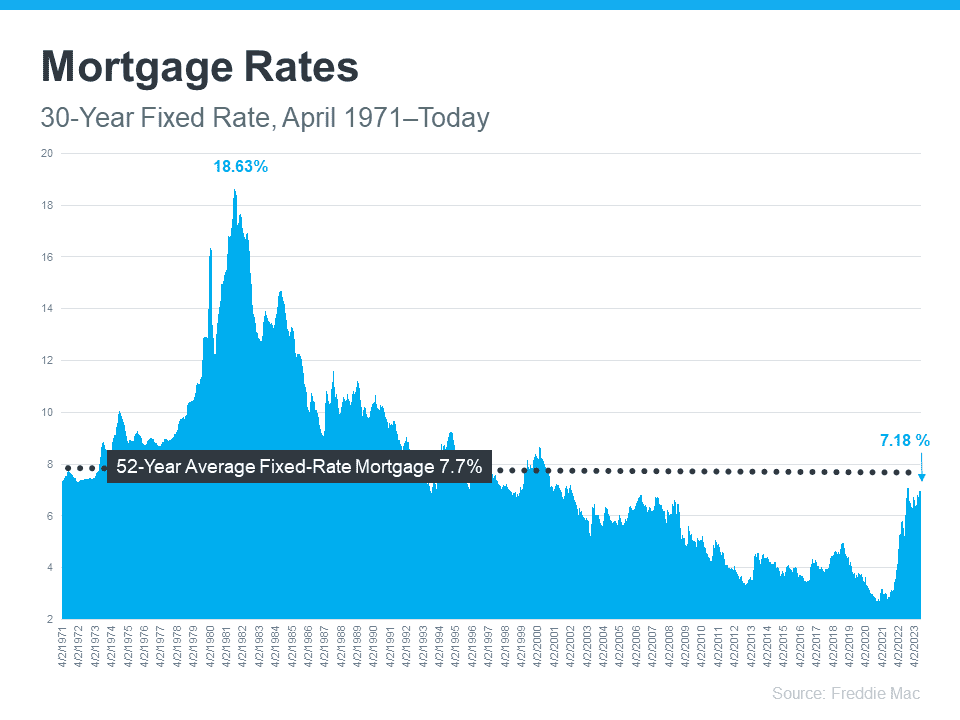

- DISCUSS YOUR OPTIONS Deciding what type of mortgage is best for you depends on your personal situation, your financial scenario, and your future plans. For example, if your down payment isn’t large enough to qualify for a conventional loan, an FHA mortgage can be an excellent option. Alternately, you may qualify for an attractive program offered at the national or local level. Mortgage programs are always changing, so ask your ABR® (me) about current options.

- INTERVIEW LENDERS As your ABR®, I can provide several recommendations, based on past home buyers’ experiences. Rates and fees are typically very competitive between lenders, so it’s often more important to focus on other factors, including the level of service provided and how well the lender has executed transactions for other buyers. The type of mortgage you are seeking may also impact your choice of lender, since some are more familiar with certain mortgage programs than others.

- GET PREAPPROVED Completing a loan application with one or more lenders will help confirm whether your intended mortgage financing plans will work out as hoped, or if you must modify your plans. However, i’s important to understand that preapprovals are contingent upon the lender receiving full documentation. Your preapproval does not guarantee that you have a mortgage. Still, it’s an important first step that will also put you in a better negotiating position with sellers.

- COMMIT TO A LENDER Show your lender that you are serious about working in partnership with them by submitting all the required documentation as quickly as possible.

These five proven steps will greatly improve your ability to get an optimal mortgage.