What Savvy Home Buyers Know That You Should Learn

Whether you’re looking for your first home, stepping up to your dream home, or downsizing to a more manageable home – buying a home is a big step for all of us, and it’s easy to feel overwhelmed. Many people shop for a home the same way they buy virtually everything these days … you get online, look at houses, see one that looks good, and click “schedule a showing” to get someone to open the door … right? WRONG! Read on to learn what savvy home buyers know that will help you buy your next home.

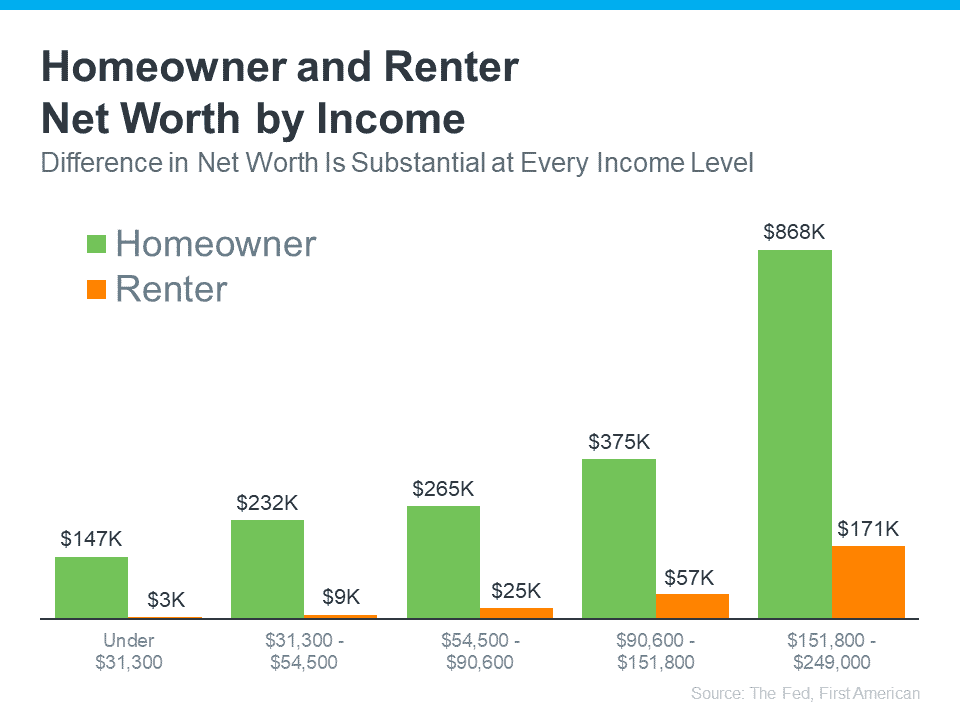

A Home is Your Single Largest Financial Investment

For most of us, our home is our single largest investment, and it will, over time, become our largest financial asset. In the long run, buying a home is a cornerstone of your net worth. The chart below compares the difference in net worth of renters versus homeowners at five different income levels. The difference in net worth is substantial at every level. If you’re a first-time home buyer or a current homeowner needing a larger home, the current market can be challenging. The key to success is to hire an experienced broker who can guide you through the process to help you secure the right home for your situation.

Savvy Home Buyers Know to Work with a Pro

Chances are you’re busy with work, family, life; you name it … the last thing you need to do is get up to speed on contract law, home inspections, and real estate negotiations, and then manage a real estate transaction … right? Doesn’t it make sense to do what savvy buyers do and hire a professional who knows the ropes and will work with you to build a home-buying strategy to get you the right home at the right price?

A Buyer Broker is Your Advocate

When you hire a Buyer’s Representative, they represent your goals and financial interests. Their duty is to guide you through the buying process from start to finish. The buyer broker not only helps you find a property but also advises you on its current market value, the strength of the neighborhood, and the long-term growth potential of the property. Remember the listing agent is hired by the seller. They have a fiduciary responsibility to protect the financial interest of the seller. Doesn’t it make sense for you to hire a professional who protects your interests?

A Buyer Broker Negotiates on Your Behalf

Once you find the right home, you need to get it under contract. Your broker completes a market analysis to help you determine a competitive offer price and terms. Based on your instructions, they draft a purchase offer and present your offer to the seller. Then they negotiate with the seller on your behalf and hopefully gain mutual acceptance and go under contract.

Next, the broker helps you navigate the home inspection process. They meet with you and the home inspector during the home inspection. Based on your instructions, they draft the Buyer Repair Addendum and negotiate repairs with the seller. As a buyer, your goal is to make sure there aren’t any dealbreaker issues with the house, and if repairs are needed, determine how much they will cost. If the inspection uncovers major issues with the home, you have three options: accept the home as is, negotiate with the seller to make repairs or adjust the purchase price, or terminate the contract. The Buyer Repair Addendum period is only ten days. This is often the most stressful part of the transaction, and your broker has the experience to help determine the best course of action for you.

A Buyer Broker is Your Project Manager

The other players on your team are your lender, your insurance agent, your escrow agent, and your home inspector. Your broker acts as the project manager for your transaction and communicates with the other members of the team to keep the process on schedule. The timeline from mutual acceptance to closing is 30 – 45 days (about one and a half months). There always seem to be a couple of bumps in the road along the way, and your realtor’s job is to smooth out those bumps, get the transaction closed, and hand you the keys to your new home.

The Buyer Consultation

Now that you have a high-level understanding of a real estate transaction, you can see that there are a lot of steps to be completed and not much time to make the right decisions. That’s why it’s so important to hire your agent first. The best way for you to hire the right agent is through a Buyer Consultation.

The Legal Stuff

The first step in the Buyer Consultation is to review the laws of agency, the purchase and sale agreement, the offer process, the negotiation process, Seller Disclosure Statements, escrow, the home inspection process, broker compensation, closing costs, closing and recording, timelines … in short, you’ll get an overview of all the steps in the home buying process.

Clarifying the Vision

A buyer consultation is tailored to help you clarify your wants, goals, and needs. Are you a first-time buyer? Upscaling? Downsizing? Relocating? By discussing your goals and determining your ‘must-haves’ versus ‘would-likes,’ we build a strategy that matches your goals.

Next, we look at properties online. Are you looking for a particular style of house? Will a fixer work? Is a fenced yard a must-have? By looking at homes together and getting your feedback, we get a feel for what you like and why. This saves time and reduces frustration. By getting a full understanding of what you’re looking for and why, we can eliminate homes that won’t work. Next, we set up property alerts that align with your must-haves. This ensures that you’ll receive an instant update on your phone when a home that matches your parameters comes on the market.

At the conclusion of the Buyer Consultation, you’ll have a good understanding of the home-buying process, and that knowledge will empower you to make informed decisions without lying awake at night.

Bottom Line

Finding your next home in today’s market has its challenges. Mortgage rates have recently dropped significantly and are expected to continue to decline in 2024. Lower rates will bring more buyers into the market, which means more competition and potential bidding wars. Lower rates will also spur homeowners who have been waiting for rates to come down to put their homes on the market and move on with their lives. This means more inventory to choose from in 2024.

If your goal is to become a homeowner in 2024 or 2025, the first step is to reach out and schedule a Buyer Consultation. The process will provide you with essential knowledge and a proven strategy to act quickly, with confidence, when the right home comes to market.

James Bradley

Principal Broker

Licensed in OR & WA

971-248-3982