3 Reasons Why Today’s Real Estate Market Isn’t Like 2008

Due to the rapid increase in interest rates the Portland housing market has cooled dramatically. In January 2022 there were about 500 homes for sale in Portland. 10 months later the inventory is about 1,600 homes for sale. Clearly the real estate market has shifted. The primary reason for the change is that the Fed has substantially raised interest rates to curb inflation. Looking at the headlines it’s easy to assume that we’re headed for a repeat of 2008. Good News! There’s hard data to show why today’s real estate market isn’t like 2008. Read on to learn the three reasons.

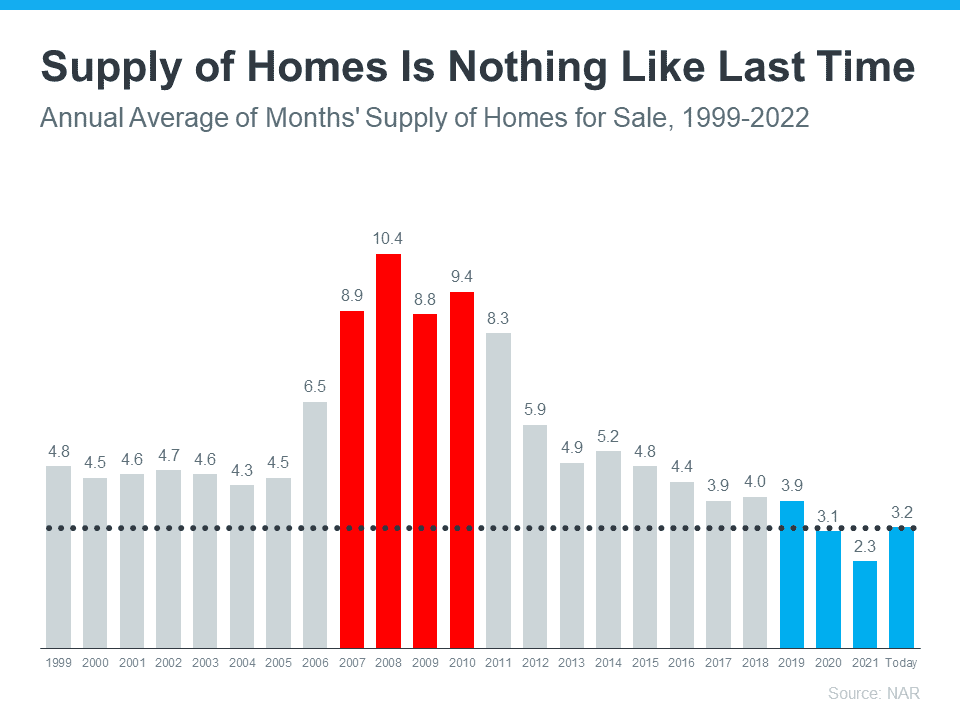

Inventory Has Increased But There’s Still a Shortage of Homes

In 2008 there were just too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. While the supply of homes has increased since the January 2022, there’s still a shortfall of inventory available for sale. The reason is two fold. First, for the past 15 years new construction has been well below average. Second, the Millennial Generation is the largest segment of the population and they’re willing and able to buy a home.

The graph below compares the supply of homes available today compared to the supply in 2008. Today, the unsold inventory nationally is at a 3.2-months’ supply. During the crash the inventory was level average around 9 month for five years. Real estate prices are always determined by supply and demand and today there just isn’t enough inventory on the market for prices to come crashing down like they did last time. That said the markets that experienced the highest appreciation over the past 2 years will likely experience the largest declines.

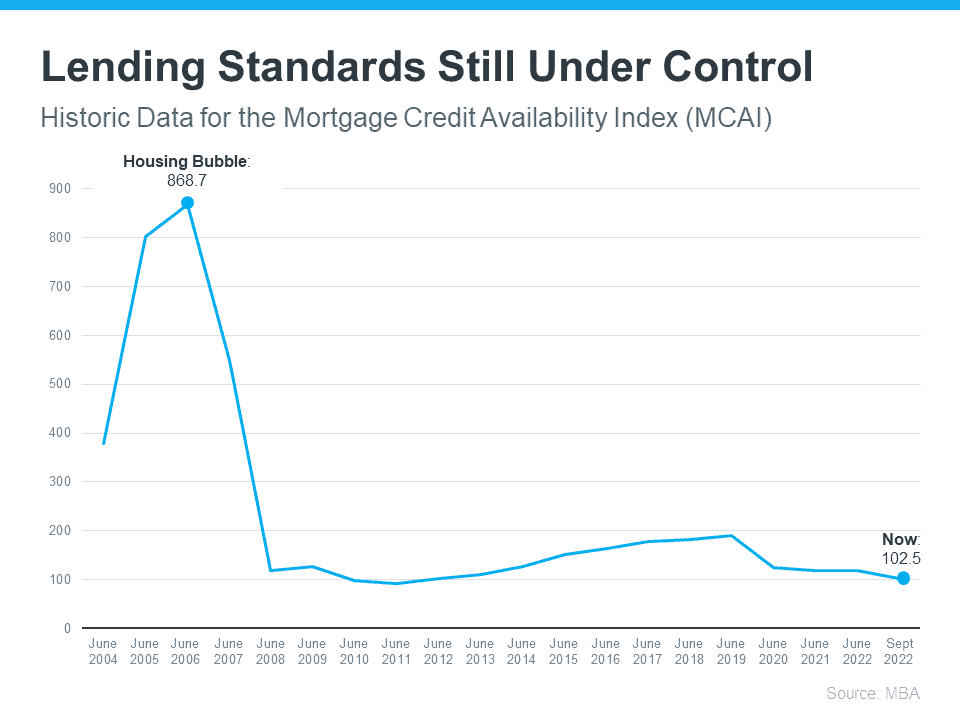

Mortgage Standards Were Much More Relaxed Back Then

One of the key elements that led to the housing crisis was relaxed lending standards. Running up to 2006, banks created artificial demand by lowering lending standards that made it easy for just about anyone to qualify for a home loan or refinance their current home.

Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. Those lax practices led to mass defaults, foreclosures, and falling prices. Part of the aftermath of 2008 was that lender guidelines were changed and purchasers face much higher standards from mortgage companies.

The graph below uses Mortgage Credit Availability Index (MCAI) data from the Mortgage Bankers Association (MBA) to help tell this story. In that index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is. In the latest report, the index fell by 5.4%, indicating standards are tightening.

This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards over the past 14 years have helped prevent a scenario that would lead to a wave of foreclosures like the last time.

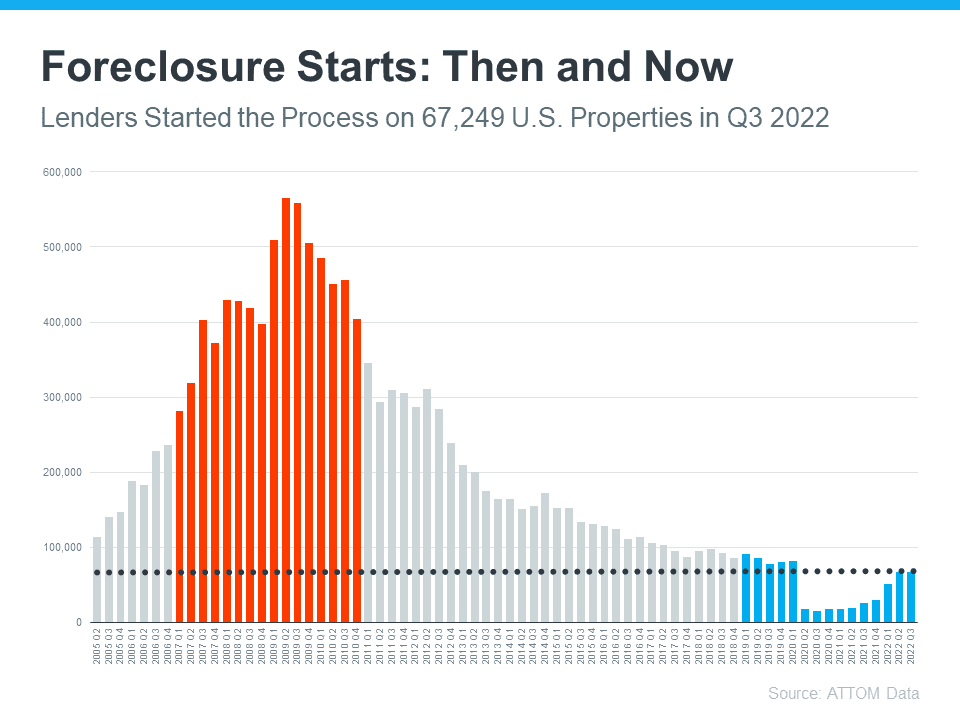

Foreclosure Volume Is Nothing Like It Was During the Crash

Another big difference is the number of homeowners that were facing foreclosure after the housing bubble burst versus today. Foreclosure activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help paint the picture of how different things are this time:

In addition homeowners today have options that just didn’t exist in the housing crisis when so many people owed more on their mortgages than their homes were worth. Today, many homeowners are equity rich. That equity comes, in large part, from the way home prices have appreciated over time. According to CoreLogic:

“The total average equity per borrower has now reached almost $300,000, the highest in the data series.”

Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains the impact this has:

“Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. . . . We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.”

Homeowners are in a completely different position this time around. For those facing economic difficulties today, likely have the option to sell their house and capture remaining equity and avoid the foreclosure process.

Bottom Line

If you’re concerned about the current market and feel that we’re heading towards a housing crash like 2008, the graphs above should help alleviate your fears. Concrete data and expert insights clearly show why today’s market shift is nothing like the the market conditions that led to the 2008 market melt down.