2024 Mortgage Rate Projections: What Buyers and Sellers Need to Know

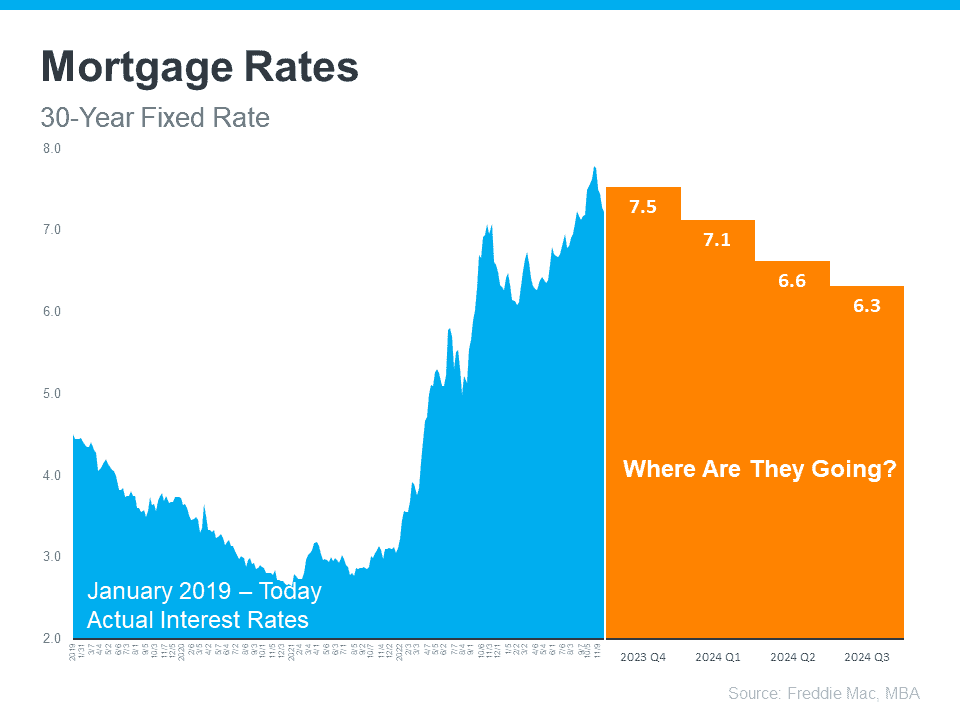

Today, we’re diving into one of the hottest topics in real estate: 2024 mortgage rate projections. Before we go any further be advised — no one can accurately predict exactly where mortgage rates will be in the future. That said, whether you’re currently a homeowner planning to move in the future or a first-time home buyer, understanding the trends in interest rates is a crucial part of your planning process.

Here are a few headlines from recent articles with their 2024 mortgage rate projections.

“The Federal Reserve will cut interest rates 6 times in 2024 as the economy shows clear signs of cooling down, ING says” — Business Insider – Nov 30, 2023

“Redfin Predicts 2024 Will Be the Year Homebuyers Catch a Break, With Home Prices Falling and New Listings Rising” – Redfin – Dec 5, 2023

“Fed holds rates steady, indicates three cuts coming in 2024” – CNBC – Dec 13, 2023

While no one can predict mortgage rates, the consensus is that rates will continue to moderate. The chart below shows the current projection for 2024 mortgage rates from Freddie MAC, MBA.

How Will Lower Mortgage Rates Affect First-Time Home Buyers?

The good news: Lower interest rates will reduce your monthly payment and increase your buying power.

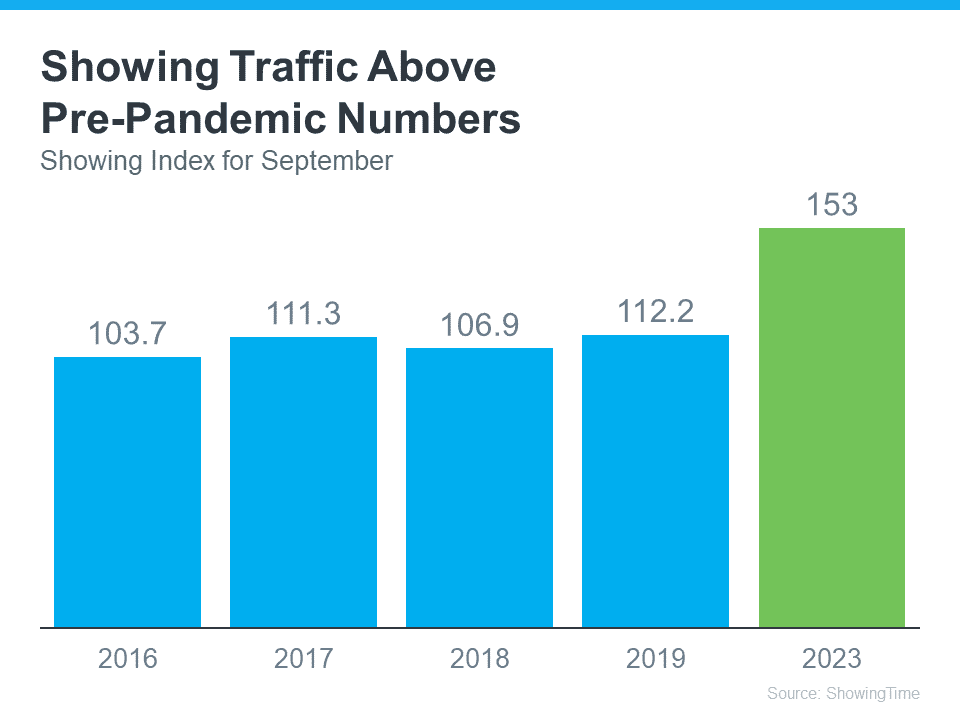

The bad news: Inventory is below normal, and more buyers will enter the market when rates drop. More buyers mean more competition, which increases the likelihood of bidding wars. The chart below shows demand is strong, when rates drop the market will heat up quickly.

The solution: If you’re serious about buying a home in 2024, now is the time to start the process. A Buyer Consultation will put you in a strong position to make a move when the time is right. Click here to learn more about a no-obligation Buyer Consultation.

How Will Lower Mortgage Rates Affect Current Home Owners?

If you’re looking to make a move to a home better suited to your current situation, you’ll likely need to sell your current home to buy a new one. The key to making a smooth transition is to start planning early. Reach out to schedule a no-obligation Seller Consultation. The Seller Consultation will provide you with:

- An assessment of your current home equity

- A review of your home’s condition and what repairs, if any, you’ll want to complete before going on the market.

- A comprehensive Sell-Buy strategy analysis.

- A Buyer Consultation to identify exactly what you want in your next home.

- A comprehensive marketing strategy to get your home sold at the best possible price and terms.

The SkyBlue Portland Real Estate Team is committed to helping you make informed decisions in this ever-evolving real estate landscape. After 18 months of rapid escalation, mortgage rates are beginning to decline. If you plan on moving in 2024, now is the time to build a strategy that will put you in a position to make your real estate dreams a reality.

To learn more about the Buyer Consultation, see: What’s A Buyer Consultation and Why Do You Need One.

To learn strategies to Sell and Buy a home in today’s market, see: How to Sell and Buy a Home at the Same Time.